How Much Are Yearly Property Taxes

4 if paid in November. Ad Make Sure Youre Charging The Right Tax Rate On Your Rental Home.

Are There Any States With No Property Tax In 2021 Free Investor Guide

You are now leaving the.

How much are yearly property taxes. Property Tax Millage Rates. We are accepting in-person online and mail-in property tax payments at this time. County Property Tax Facts.

Pay your taxes in full by November 15 or make partial payments with further installments due in February and May. Property Tax bills are mailed to property owners by November 1 of each year. The county assessor places the taxes certifies by the taxing districts on the tax roll in the Fall of each year.

You Can See Data Regarding Taxes Mortgages Liens Much More. Estimate the propertys market value. Property taxes are placed on the tax roll in the form of a rate per 1000 of assessed value.

For example a property with an initially assessed value of 225000 is taxed at 1 per year and the assessed value is automatically increased by 2 per year. The Tax Collector may have a program to assist you with deferring taxes and paying in quarterly installments. Property tax statements are mailed before October 25 every year.

The median property tax in Pennsylvania is 222300 per year for a home worth the median value of 16470000. The County is committed to the health and well-being of the public and our employees and. Tax amount varies by county.

You can check your local assessor or municipalitys website or call the tax office for. Property Tax Returns and Payment. Taking the mill levy of 45 we calculated previously the tax due would be 1800 40000 x 45.

Lee County Tax Collector site. Real estate property refers to the physical land and everything attached to the land such as houses barns garages etc. Real estate property also includes property that can be removed from the land such as a single-wide mobile home attached to.

The assessed value would be 40000. For Class 1 Properties and Class 2. If the 15th falls on a weekend or holiday due date is the next business day.

See your tax bill for details. Excluding Los Angeles County holidays. A schedule will be created listing each year and a total tax amount.

1 if paid in February. Non-deductible real property charges Certain items on your real estate property tax bill may look like taxes but are actually miscellaneous charges that are. The following early payment discounts are available to Orange County taxpayers.

Counties in Pennsylvania collect an average of 135 of a propertys assesed fair market value as property tax per year. Online information - E-mail address. 2 if paid in January.

53 rows Effective Propert Tax Rate Property Tax Rev General Sales Individual Income Corporate. The states average effective rate is 242 of a homes value compared to the national average of 107. In general you can expect your homes assessed value to amount to about 80 to 90 of its market value.

Property Taxes in Georgia. A propertys annual property tax bill is calculated by multiplying the taxable value with the tax rate. Overall homeowners pay the most property taxes in New Jersey which has some of the highest effective tax rates in the country.

For reference the median home value in Riverside County is 330600 and the median annual property tax payment is 3144. Beginning in 2018 the total amount of deductible state and local income taxes including property taxes is limited t 10000 per year. Property Taxes by State.

When the discount period ends on a weekend or holiday the discount is extended to the next business day. The table above shows the fifty states and the District of Columbia ranked from highest to lowest by annual property taxes as a percentage of. 3 if paid in December.

Starting Year The starting year of the years you want to calculate. 45 rows The average American household spends 2471 on property taxes for their homes each year. Real Estate Property Tax is based on the value of real estate as of January 1st of the current year.

The Department of Finance determines the market value differently depending on they type of property you own. The Property Appraiser does not determine the amount of taxes. The assessed value in this year is the value you entered above.

Since assessed values rise or fall to equal purchase price when a home is bought or sold homeowners in Riverside County can expect to. 4 discount if paid in November 3 discount if paid in December. Property Tax Homestead Exemptions.

Effective October 1 2021 we are resuming limited in-person services at the Kenneth Hahn Hall of Administration Monday through Friday between 800 am. Enter the number of years you want to calculate property taxes. Multiply the estimated market value by the level of assessmentî which is 6 Tax Class 1 or 45 all other classes.

Ad Get a Vast Amount of Property Information Simply by Entering an Address. The full amount of taxes owed is due by March 31. In most cases the taxes for operations are the permanent rate limits certified by the districts.

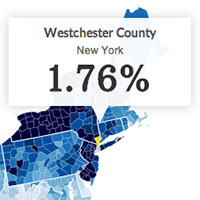

If you believe your taxes are too high you should contact the taxing authority. Taxes can be even higher in particular areas such as Westchester County where annual property taxes can easily top 24000.

Most People Know That Homeownership Requires Coughing Up Copious Amounts Of Money There S Your Mortgage Of Course But The Costs Property Tax Calculator Tax

Property Taxes How Does Your County Compare Cnnmoney Com

Understanding California S Property Taxes

Property Tax Proration Calculator Calculate Tax Per Diem Estate Tax Mortgage Payoff Property Tax

Property Taxes How Much Are They In Different States Across The Us

Cook County Il Property Tax Calculator Smartasset Retirement Calculator Property Tax Retirement Strategies

Florida Property Tax H R Block

Washington Property Tax Calculator Smartasset Com Property Tax Property Washington

Property Taxes In Turkey Property Tax Tax Real Estate Buying

Secured Property Taxes Treasurer Tax Collector

The Hidden Costs Of Owning A Home

Deducting Property Taxes H R Block

Property Tax Proration Calculator Calculate Tax Per Diem Property Tax Estate Tax Tax

Property Taxes Department Of Tax And Collections County Of Santa Clara

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

The Average Amount People Pay In Property Taxes In Every Us State

Posting Komentar untuk "How Much Are Yearly Property Taxes"