How To File Homestead Exemption In Tarrant County Texas

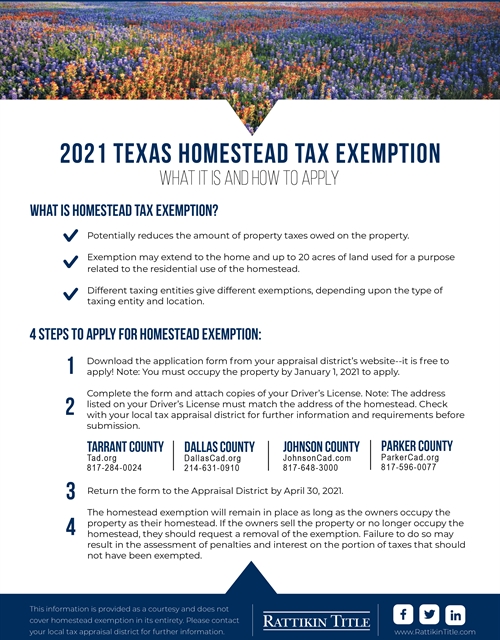

This is a FREE service. To apply for this exemption taxpayers must submit a completed application along with a drivers license or state-issued personal ID certificate that has the same address as the property they are applying for the exemption on.

New Construction Homes In Mansfield Texas New Home Vs Existing Home New Construction Mansfield Texas New Homes

You must be the owner of the subject residence as of January 1st of the applicable tax year.

/https://static.texastribune.org/media/images/2017/08/12/UP9A0022.JPG)

How to file homestead exemption in tarrant county texas. Just follow these easy steps. If the deed was filed by Jnauary 1st the home owner should receive the deed in late December or early January. Mail the completed form to the address at the bottom of the Denton Cad website.

Do not file this document with the Texas Comptroller of Public Accounts. COUNTY APPRAISAL DISTRICT OFFICES. If you need to change your address on your TX drivers license or TX ID card to your homestead property address please visit one of the Texas Department of Public Safety DPS locations.

According to the Tarrant County Central Appraisal District they will automatically mail a homestead exemption form to the home owners address of record. Hover on the Taxpayer Info tab select Forms Exemptions. How To File Homestead Exemption Tarrant CountyHave you ever had these questionsHow do I file a homestead exemptionWhat is a homestead exemption.

PdfFiller allows users to edit sign fill and share all type of documents online. HOW TO FILL OUT HOMESTEAD EXEMPTION FORM IN TEXAS HOMESTEAD EXEMPTION HARRIS COUNTYIn order to lower your annual property taxes if you bought a home last. A general residential homestead exemption is available to taxpayers who own and reside at a property as of January 1 st of the year.

Filing this exemption is free of. A copy of your valid Texas drivers license or identification card with an address matching your homestead address. The typical deadline for filing a county appraisal district homestead exemption application is between January 1 and April 30.

It is a crime to make false statements on a homestead application or to file on more than one property. Any taxing unit including a city county school or special district may offer an exemption of up to 20 percent of a residence homestead. For a complete list of forms please visit the Texas State Comptrollers website.

Ad Download Or Email TAD 1320 More Fillable Forms Register and Subscribe Now. How to file for the Homestead Exemption A qualified Texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. 1 and April 30 of the year for which the exemption is requested.

Applies if 1 your deceased spouse died in a year in which he or she qualified for the exemption under Tax Code Section 1113d 2 you were 55 years of age or older when your spouse passed away and 3 the property was your residence homestead when your deceased spouse died and is still your residence homestead note that you cannot receive this exemption. Once you receive the exemption you do not need to reapply unless the chief appraiser sends you a new application. You may file for a homestead exemption for up to one year after the taxes are due.

To qualify you must own and reside in your home on January 1 of the year application is made and cannot claim a homestead exemption on any other property. A Texas homeowner may file a late county appraisal district homestead exemption application if they file no. The clerk will usually want to see a certificate of trust and a section of the trust that.

All homestead applications must be accompanied by a copy of applicants drivers license or other information as required by the Texas Property Tax Code. Complete print the form. Tax Code 1113c and d you must file the completed application with all required documentation between January 1 and no later than April 30 of the year for which you are requesting an exemption.

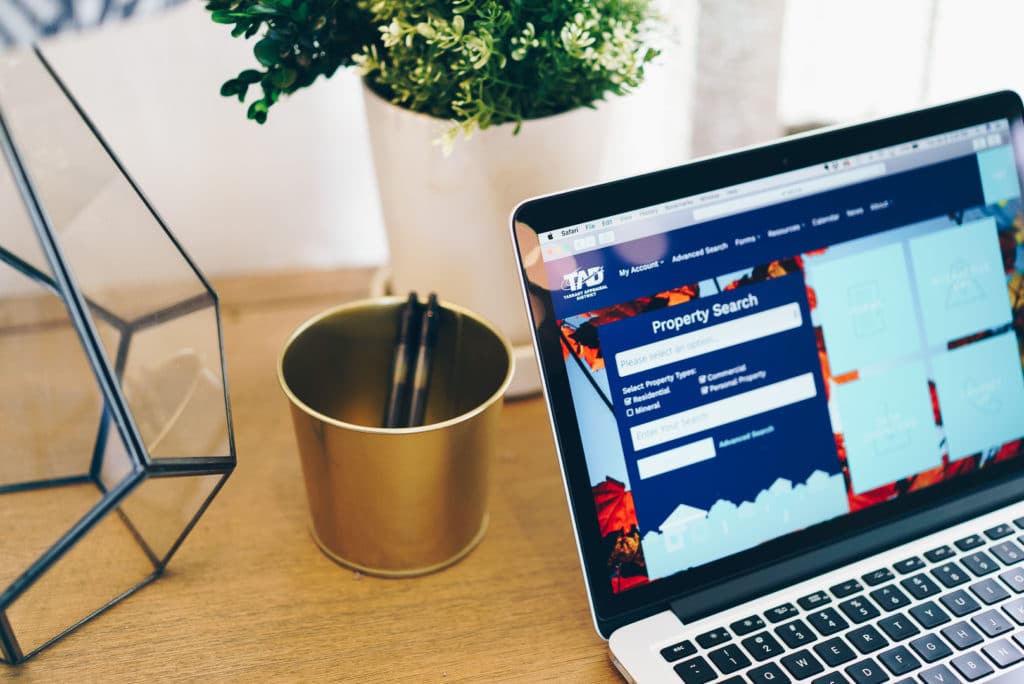

You must occupy the residence as your principal residence as of January 1st of the applicable tax. For more information please visit the Tarrant County Appraisal District web site. Expand the Homeowners section select Residence Homestead Exemption Affidavits.

It is good practice to re-file for Texas homestead exemption once the deed is recorded. 1 accomplish your Property Search or Advanced Search 2 above the search results first select either Page Results or All Results 3 then select either Excel File or TXTCSV File and lastly 4 select either the Basic or Comprehensive data option see details below. Ad Download or Email TX 50-114 More Fillable Forms Register and Subscribe Now.

The homeowner must be an individual and use the home as his or her principal residence as of January 1 of the tax year. TARRANT COUNTY HOMESTEAD EXEMPTION FILING INSTRUCTIONS. The data file type you select will be exported to your PCs Macs tablets or smart phones download folder the.

For the 25000 general homestead exemption you may submit an Application for Residential Homestead Exemption PDF and supporting documentation with the appraisal district where the property is located. If you qualify for an age 65 and over homestead exemption provided in Tax Code 1113c. Once you receive the exemption you do not need to reapply unless the chief appraiser sends you a new application.

The owner cannot receive both exemptions. Its a simple form to be filled out and mailed to the Tarrant Appraisal District. Call the Tarrant Appraisal District at 817-284-0024.

Filing your residential homestead exemption is an excellent opportunity for homeowners to combat high Texas property taxes. You could be found guilty of a Class A misdemeanor or a state jail felony under 3710 Penal Code. Although requirements can differ from county to county most county clerks will requirein addition to the deed and application for homestead exemptionsome evidence that the trust meets the definition of a qualifying trust.

Surviving Spouse of Individual Who Qualified for Age 65 or Older Exemption Under Tax Code Section 1113d. General qualifications for the Residence Homestead exemption include. File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between Jan.

Applicant may also be required to complete an affidavit to qualify for an exemption under certain situations. If the owner qualifies for both the 10000 exemption for age 65 or older homeowners and the 10000 exemption for disabled homeowners the owner must choose one or the other for school district taxes. To complete your Residence Homestead Exemption Application you will need The Residence Homestead Exemption Application Form 50-114 for your county appraisal district.

The application must be applied for on or before April 30th. Apply for homestead exemptions.

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exemption Real Estate New Homeowner Real

What You Need To Know This Tax Season Mysouthlakenews

How To File Homestead Exemption Tarrant County Youtube

How Much Savings Is My Texas Homestead Exemption Fort Worth Texas Real Estate

Property Tax Relief Available To Texas Homeowners Through Homestead Exemptions The Texas Tribune

2021 Texas Homestead Tax Exemption

How To Fill Out Homestead Exemption Form Texas Homestead Exemption Harris County Youtube

How To File Your Texas Homestead Tax Exemption League Real Estate

Tarrant Appraisal District How To Complete A Residential Homestead Application Facebook

Title Tip How To File For Your Homestead Exemption

6 Things To Know About Filing A 2017 Homestead Exemption

/cloudfront-us-east-1.images.arcpublishing.com/gray/UA5GCZVLXJGN3KOLYVAYCGJMW4.jpg)

Scam Pretends To Offer Homestead Tax Exemption

How To File Homestead Exemption Tarrant County Youtube

Residence Homestead Exemption Information Youtube

How To File Your Texas Homestead Tax Exemption League Real Estate

How To Fill Out Your Texas Homestead Exemption Form Youtube

Texas Property Taxes Homestead Exemption Explained Carlisle Title

Posting Komentar untuk "How To File Homestead Exemption In Tarrant County Texas"