What Is The Sales Tax In Texas 2020

This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. Every 2021 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 15 the Texas cities rate 0 to 2 and in some case special rate 0 to 2.

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Select the Texas city from the list of popular cities below to see its current sales tax rate.

What is the sales tax in texas 2020. Municipal governments in Texas are also allowed to collect a local-option sales tax that ranges from 0 to 2 across the state with an average local tax of 1368 for a total of 7618 when combined with the state sales tax. Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent. In the state of Texas sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Groceries prescription drugs and non-prescription drugs are exempt from the Texas sales tax. Texas has state sales tax of 625 and allows local governments to collect a. What is the sales tax percentage in texas 2020.

The minimum combined 2021 sales tax rate for Houston Texas is 825. With local taxes the total sales tax rate is between 6250 and 8250. The County sales tax rate is 0.

2020 Texas State Sales Tax Rates The list below details the localities in Texas with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. Our Team Includes CPAs Lawyers Former Auditors Other Sales Tax Professionals. Transparent Flexible Fixed-Fee Pricing.

The amount of tax you pay is typically figured as a percentage of the sale price. An example of items that are exempt from Texas sales tax are items specifically purchased for resale. The state general sales tax rate of Texas is 625.

The Houston sales tax rate is 1. Texas has recent rate changes Thu Jul 01 2021. Dallas houston and san antonio all have combined state and local sales tax rates of 825 for example.

41 rows This page will be updated monthly as new sales tax rates are released. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805.

The December 2020 total local sales tax rate was also 8250. This limit includes property and sales tax combined. The current total local sales tax rate in Dallas TX is 8250.

Cities andor municipalities of Texas are allowed to collect their own rate that can get up to 2 in city sales tax. For other states see. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Texas local counties cities and special taxation districts.

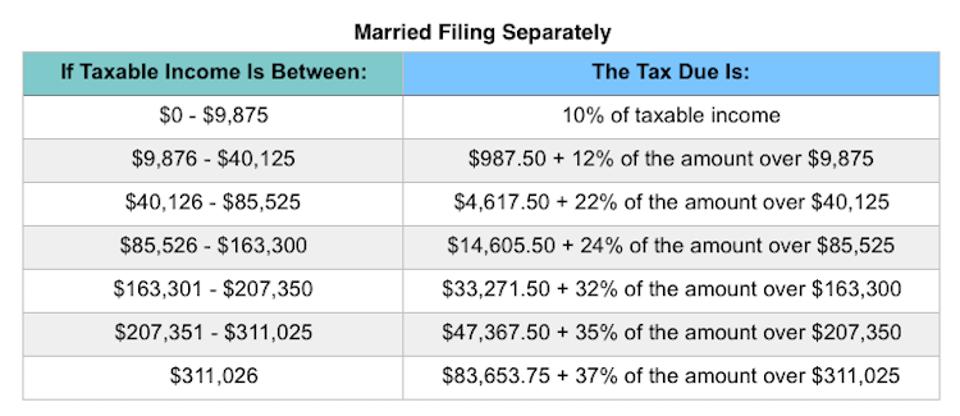

The sales tax limit for tax year 2020 is 10000 or 5000 if youre married and filing separately. The Texas sales tax rate is currently 625. The maximum local tax rate allowed by Texas law is 2.

Download and further analyze current and historic data using the Texas Open Data Center External Link. Your Business Partner for All Things Sales Tax. Sales Tax Audit Help - Call Sales Tax Helper LLC.

Texas has a 625 statewide sales tax rate but also has 815 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1368 on top of the state tax. Texas has a statewide sales tax rate of 625 which has been in place since 1961. Local Sales Tax Rate Information Report.

Counties and cities can charge an additional local sales tax of up to 2 for a. The rates shown are for each jurisdiction and do not represent the total rate in the area. Box or Route number City State ZIP code Texas Sales or Use Tax Permit Number or out-of-state retailers registration number or date applied for Texas Permit - must contain 11 digits if from a Texas.

This means that an individual in the state of Texas purchases school supplies and books for their children would. As of 2020 45 states and an array of counties and cities charge a sales tax. A sales tax is a direct tax on consumption that many states and local governments impose when you purchase goods and services.

Other Texas Taxes 2020 Cod Notice About 2020 Tax Rate City Of Odem Texas Incorporated In 1903 - Dallas houston and san antonio all have combined state and local sales tax rates of 825 for example. TEXAS RESALE CERTIFICATE 01-339 Rev12-024 Name of purchaser firm or agency Phone Area code and number Address Street number PO. This is the total of state county and city sales tax rates.

These limits are for taxes due by May 17 2021 the IRSs extended deadline to file individual tax returns for 2020. The December 2020 total local sales tax rate was also 8250. The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose sales and use tax up to 2 percent for a total maximum combined rate of 825 percent.

Sales And Use Tax Rates Houston Org

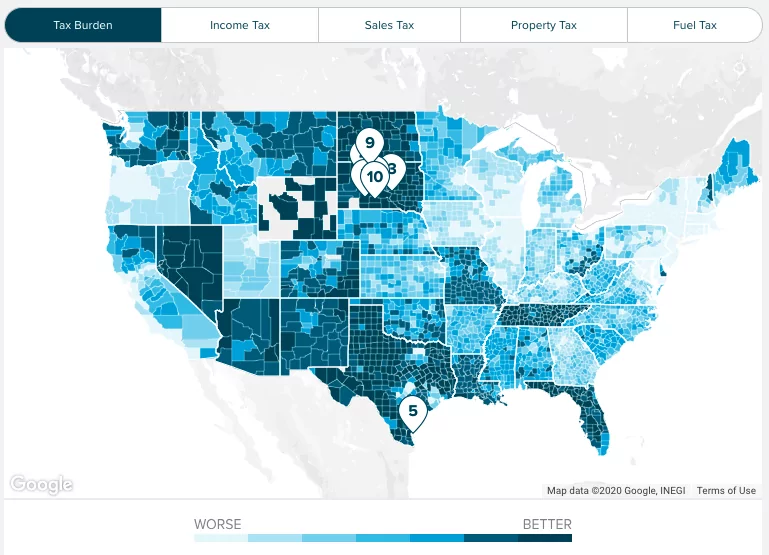

This Is The Most Expensive State In America According To Data Best Life

Sales Tax On Grocery Items Taxjar

How To Register For A Sales Tax Permit Taxjar

What Transactions Are Subject To The Sales Tax In Texas

How To Charge Your Customers The Correct Sales Tax Rates

Georgia Income Tax Calculator Smartasset

Texas Sales Tax Small Business Guide Truic

States With Highest And Lowest Sales Tax Rates

Sales Tax Revenues Show Big Texas Cities On Mend From Pandemic Houston Public Media

Is Food Taxable In North Carolina Taxjar

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More Tncpa

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More Tncpa

Welcome To Montgomery County Texas

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

States With Highest And Lowest Sales Tax Rates

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

Posting Komentar untuk "What Is The Sales Tax In Texas 2020"