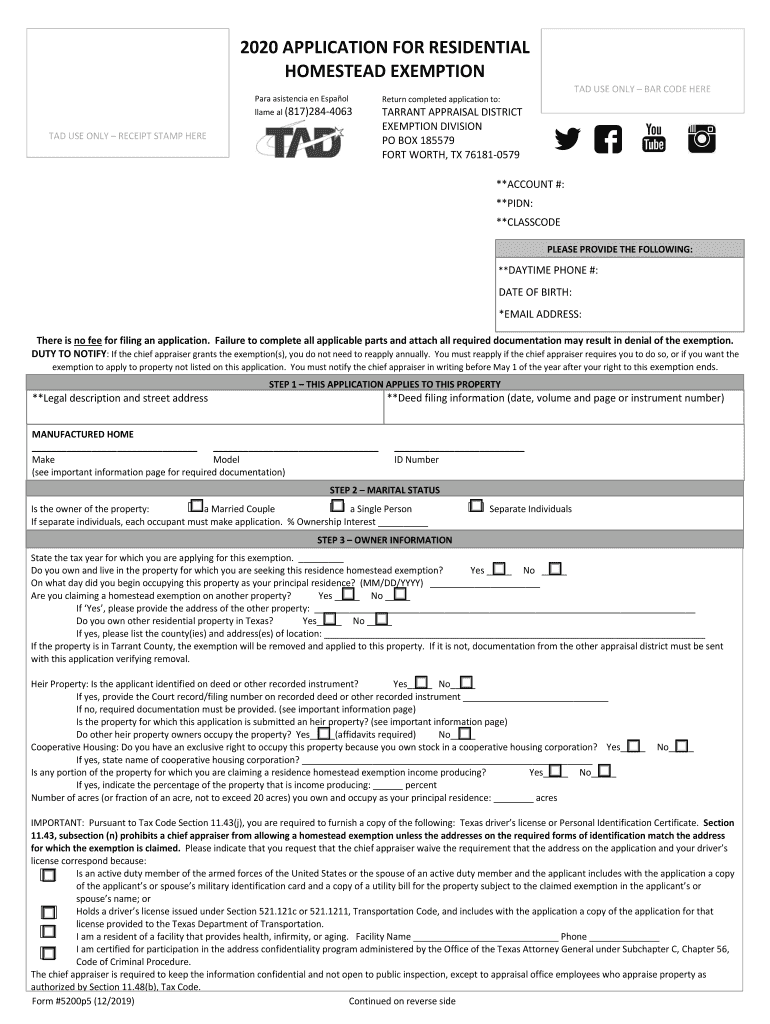

Homestead Exemption Tarrant County Form

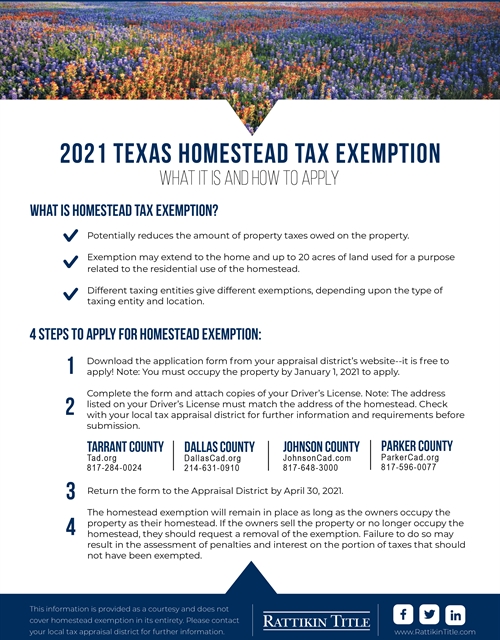

Homestead Property Tax Exemption. 1 of the tax year in which the property owner.

Homestead Exemption Carlisle Title

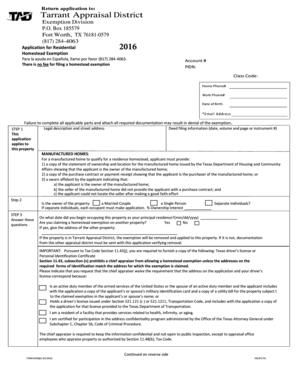

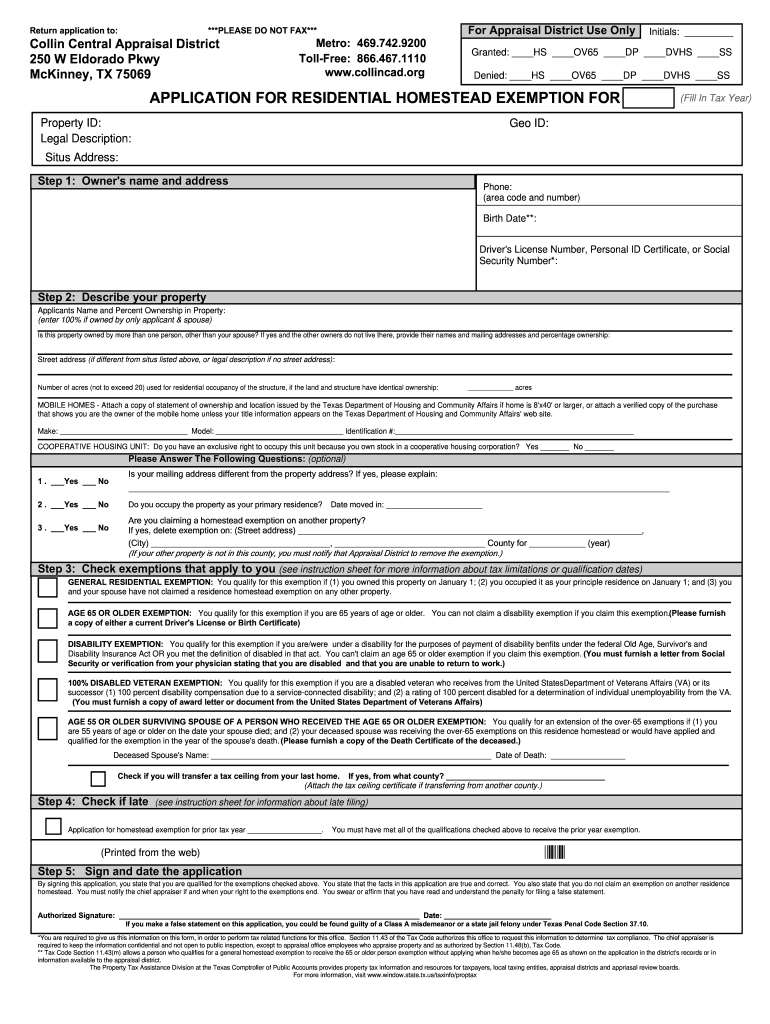

50-114 04-1221 _____ _____ Appraisal Districts Name Phone area code and number _____ Street Address City State ZIP Code.

Homestead exemption tarrant county form. Member Application Form New Dashboard and Search Results Page Updates. Follow the directions for filing your. 50-297 Application for Exemption of Raw Cocoa and Green Coffee Held in Harris County PDF 50-299 Application for Primarily Charitable Organization Property Tax Exemption501c2 Property Tax Exemptions PDF 50-310 Application for Constructing or Rehabilitating Low-Income Housing Property Tax Exemption PDF.

For the 25000 general homestead exemption you may submit an Application for Residential Homestead Exemption PDF and supporting documentation with the appraisal district where the property is located. Many forms in Texas are not available in a fill-in-the-blank. Signature property appraiser or deputy Date Entered by Date.

Residence Homestead Exemption Application. Ad Download Or Email TAD 1320 More Fillable Forms Register and Subscribe Now. Contact the appraisal district for more information.

Individuals age 65 or older or disabled residence homestead owners qualify for a 10000 homestead exemption for school district taxes in addition to the 25000 exemption for all homeowners. The tax assessor will show up at your property or use specialized software to perform a property tax assessment. 78 rows HS001 General Homestead exemption.

Age 65 or Older Exemption Tax Code Section 1113c and d This exemption is effective Jan. Find your property on the appraisal district site and open that page to show your account. Denton County Appraisal District.

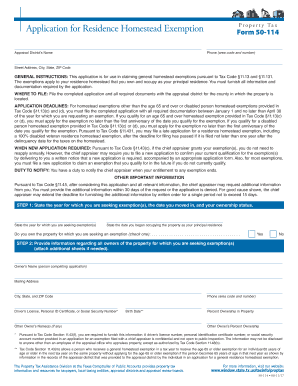

An alphabetical-by-topic list is provided below containing information and downloadable PDF forms when available or links to external resources. Application for Residence Homestead Exemption. The application for homestead exemption Form DR-501 and other exemption forms are on the Departments forms.

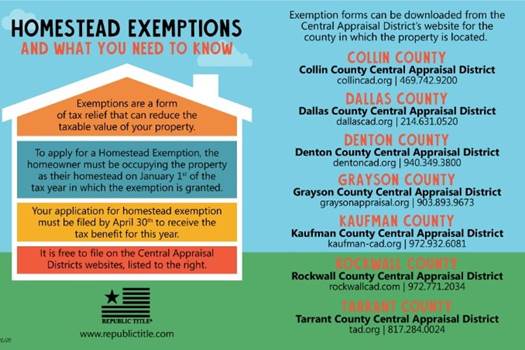

The property tax rate in Tarrant County is 210if your home value is 100000 that means you will have to pay 2100 in annual property taxes. Collin County Appraisal District. Internet Explorer 9 and.

Just find the link and click on it. Age 65 or older and disabled exemptions. However you may be asked to reapply periodically as the Tarrant Appraisal District TAD fulfills our obligation to ensure that our records remain current.

Tarrant County is not responsible for the content of nor endorses any site which has a link from the Tarrant County web site. To file a Homestead Exemption application online please visit the Homestead Exemption landing page located here. OH Optional Homestead exemption.

1143 subsection n prohibits a chief appraiser from allowing a homestead exemption unless the addresses on the required forms of identification match the address for which the exemption is claimed. However in any case where legal reliance on information contained in these pages is required the official records of. You will need to complete all applicable parts of the form which includes signing and dating it.

Please indicate that you request that the chief appraiser waive the requirement that the address on the application and your drivers. Some accounts in Tarrant County may also have tax payment requirements to the Grapevine-Colleyville Tax Office How Do I File For a Homestead Exemption Online. An exemption is also available for those who are age 65 or older.

Tarrant County provides the information contained in this web site as a public service. Or To obtain a copy from Social Security telephone 1-800-772-1213 You may receive this exemption in addition to the exemptions provided in 1113a b General Residence Homestead. See Form 50-114-A An eligible disabled person age 65 or older may receive both exemptions in the same year but not from the same taxing units.

Page and on most property appraisers websites. This affidavit is for use when claiming residence homestead exemptions pursuant to Tax Code Sections 1113 11131 11132 11133 11134 and 11432. Once you receive the exemption you do not need to reapply unless the chief appraiser sends you a new application.

Ad Download Or Email TAD 1320 More Fillable Forms Register and Subscribe Now. There should be a choice for forms or exemptions. This site is best experienced with supported browsers.

The Dell DeHay Law Library of Tarrant County makes available many commonly-requested forms to its patrons. Every effort is made to ensure that information provided is correct. This is a one-time application.

Ad Download Or Email TAD 1320 More Fillable Forms Register and Subscribe Now. The property appraiser has a duty to put a tax lien on your property if you received a homestead exemption during the. Texas imposes property taxes as the percentage of each propertys estimated value.

If the owner qualifies for both the 10000 exemption for age 65 or older homeowners and the 10000 exemption for disabled homeowners the owner must choose one or the. This list is not comprehensive. Tarrant Appraisal District.

Tarrant Appraisal Review Board is now accepting applications for the 2022-2023 term. There is no fee for filing a Residence Homestead exemption application. Click here for county property appraiser contact and website.

A homestead exemption is available to any homeowner who qualifies. Attach the completed and notarized affidavit to your. This application is for use in claiming general homestead exemptions pursuant to Tax Code 1113 and 11131.

General qualifications for the Residence Homestead exemption include. For filing with the appraisal district office in each county in. File the signed application for exemption with the county property appraiser.

Rockwall County Appraisal District.

How To File Homestead Exemption Tarrant County Youtube

How Do I Tarrant Appraisal District

How To Fill Out Homestead Exemption Form Texas Homestead Exemption Harris County Youtube

Tad Fill Online Printable Fillable Blank Pdffiller

What You Need To Know About Homestead Exemptions Robson Resales

How To File Your Texas Homestead Tax Exemption League Real Estate

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exemption Real Estate New Homeowner Real

Residence Homestead Exemption Information Youtube

How Much Savings Is My Texas Homestead Exemption Fort Worth Texas Real Estate

2020 Form Tx 5200 Fill Online Printable Fillable Blank Pdffiller

2021 Texas Homestead Tax Exemption

Collin County Homestead Exemption Form Fill Online Printable Fillable Blank Pdffiller

Title Tip How To File For Your Homestead Exemption

Form 50 114 Fill Online Printable Fillable Blank Pdffiller

Title Authorization Example Homestead Exemption Fill Out And Sign Printable Pdf Template Signnow

Homestead Exemption Mysouthlakenews

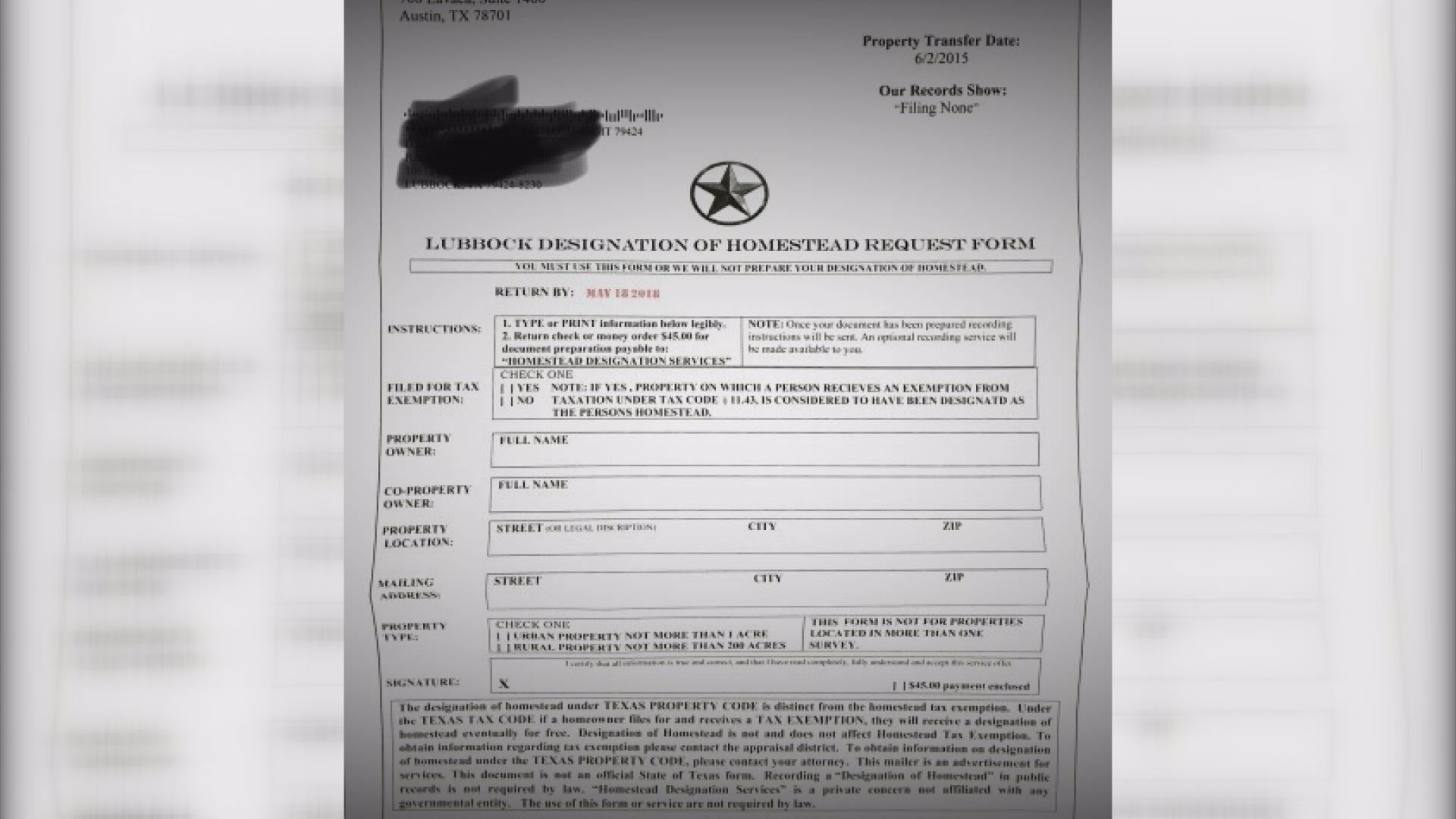

Scam Pretends To Offer Homestead Tax Exemption

Posting Komentar untuk "Homestead Exemption Tarrant County Form"