State College Property Tax Rate

Find information about property types real estate millage and the Tax Relief Act of 2006. Assesses rates andor values all real estate occupations property and individuals subject to taxation by County local taxing authorities.

How High Are Cell Phone Taxes In Your State Tax Foundation

Read about Municipalities Extend Real Estate Tax Payment Deadlines and more from the State College PA region.

State college property tax rate. Relationship Between Property Values Taxes. A home with a full and true value of 230000 has a taxable. Taxes Property Tax Assistance Tax Rates and Levies Tax Code Section 5091 requires the Comptrollers office to prepare a list that includes the total tax rate imposed by each taxing unit in this state as reported to the comptroller by each appraisal district.

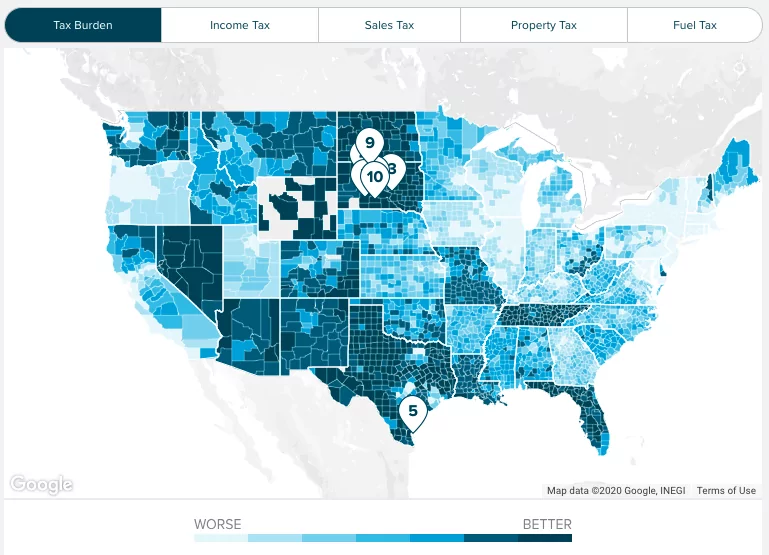

August 1 2020 to September 30 2020. The property tax rate as of October 1 2021 for the City of College Station will be set at 534618 per 100 of assessed valuation. Scroll down to find all about these vital property taxes by state segments.

In calendar year 2019 the most recent data available New Jersey had the highest effective rate on owner-occupied property at 213 percent followed by Illinois 197 percent and New Hampshire 189 percent. The County School District and Borough each levy taxes on real estate. State College Area School District Real Estate Tax Bills will be mailed August 1 2020.

The table above shows the fifty states and the District of Columbia ranked from highest to lowest by annual property taxes as a percentage of. Real estate taxes are based on the assessed value of your property as determined by the Centre County Board of Assessment. State College PA property tax assessment.

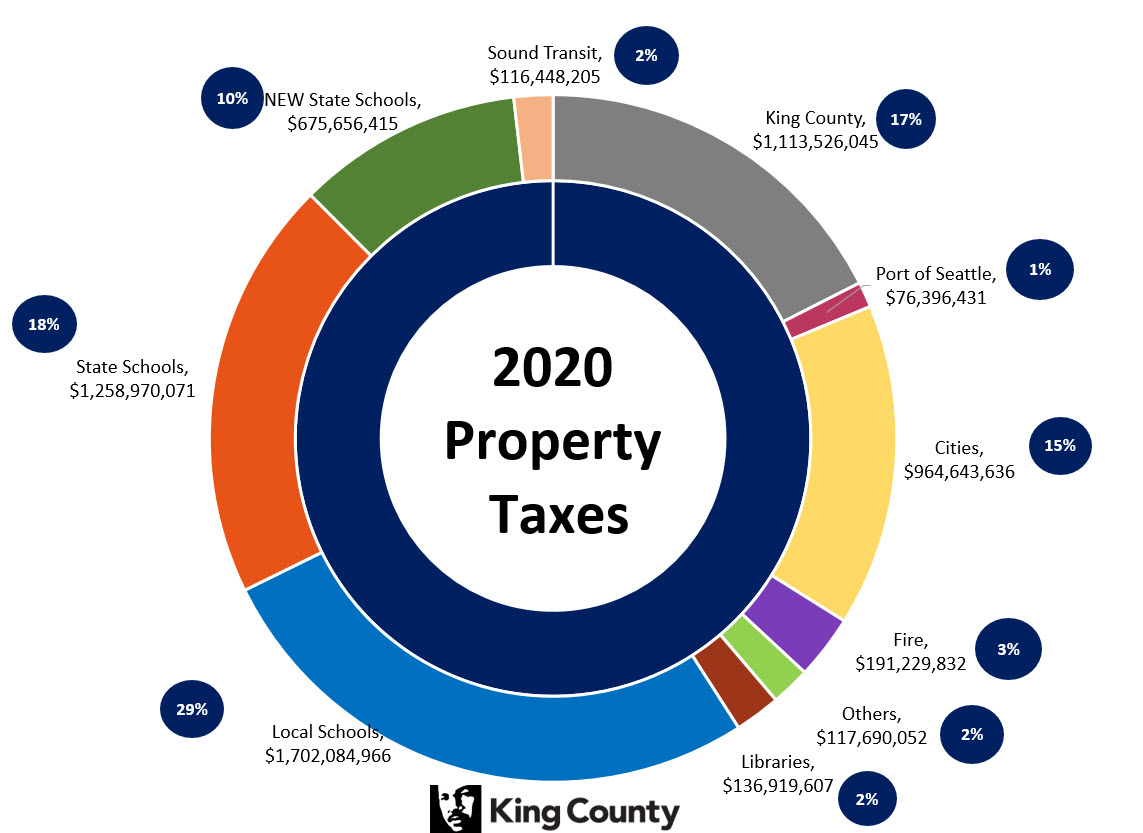

The School District taxes are the largest portion of the property taxes followed by cities the community college districts special districts and the State. Nonprofit educational institutions of collegiate grade may be eligible for exemption from property taxes through either the College Exemption or the Welfare Exemption. Enter an Address to Receive a Complete Property Report with Tax Assessments More.

Prior to the economic downturn property values were increasing annually reaching a high of 58 billion in assessed value in fiscal year 2009. Business Office and Finance Department. The breakdown of the tax rate is as follows.

Semiannual payments are offered for owner-occupied residential property only. The tax assessor collector provides consolidated tax assessment and collection services for all taxing jurisdictions within Brazos County. Ad Search County Records in Your State to Find the Property Tax on Any Address.

Deadline for local real estate property taxes. Tax Lien - a charge to enforce unpaid taxes fines etc. Check out photos from the neighborhood planning process.

Property Taxes fund the General Fund and are used to make payments on the Citys Debt Service Fund. Research the property transfer tax rates that you are looking for by browsing our listings of State College PA tax rates. Effective Real-Estate Tax Rate.

Then the property is equalized to 85 for property tax purposes. Finally the per-capita property tax in the US is 1618. For State County and Municipal governments for further information contact the Treasury Division at 301-952-4030 Payments Tax bills must be paid by September 30th in full unless paying semiannually.

The State College Area School Board on Monday approved a proposed final 2021-22 budget that includes no real estate tax increase but that could change before the final budget is. Information on specific property tax accounts can be accessed through the Brazos County Tax Office website. The above tool is intended to provide a gross estimate of the possible tax impact of the high school project.

1st Avenue W Aaron Drive Aberdeen Lane Abington Circle Adams Avenue Airport Road N Allen Street S Allen Street Alma Mater Court Alma Mater Drive. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would be 85. 45 rows State.

Due Dates for payment of the school real estate tax bills are as follows. 4 The percentage tax increase is calculated based on the 2014-15 property tax rate of 41674 mills or 41674 per 1000 of assessed value. See reviews photos directions phone numbers and more for Property Taxes locations in State College PA.

Annual Taxes on 2175K Home State Median Home. The total property tax as a percentage of state-local revenue is 1693 while the property tax percentage of personal income stands at 312. Colleges that are part of the public school system such as community colleges state universities including the University of California are exempt under public schools.

Amblewood Way Arbor Way Asbury Lane N Atherton Street S Atherton Street Autumnwood Drive Azalea Drive B Alley Bailey Lane Bald Eagle. Wednesday September 8 2021.

New York Property Tax Calculator 2020 Empire Center For Public Policy

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Understanding California S Property Taxes

The States Where People Are Burdened With The Highest Taxes Zippia

Massachusetts Property Tax Calculator Smartasset

Pennsylvania Income Tax Calculator Smartasset

Alabama Property Tax H R Block

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

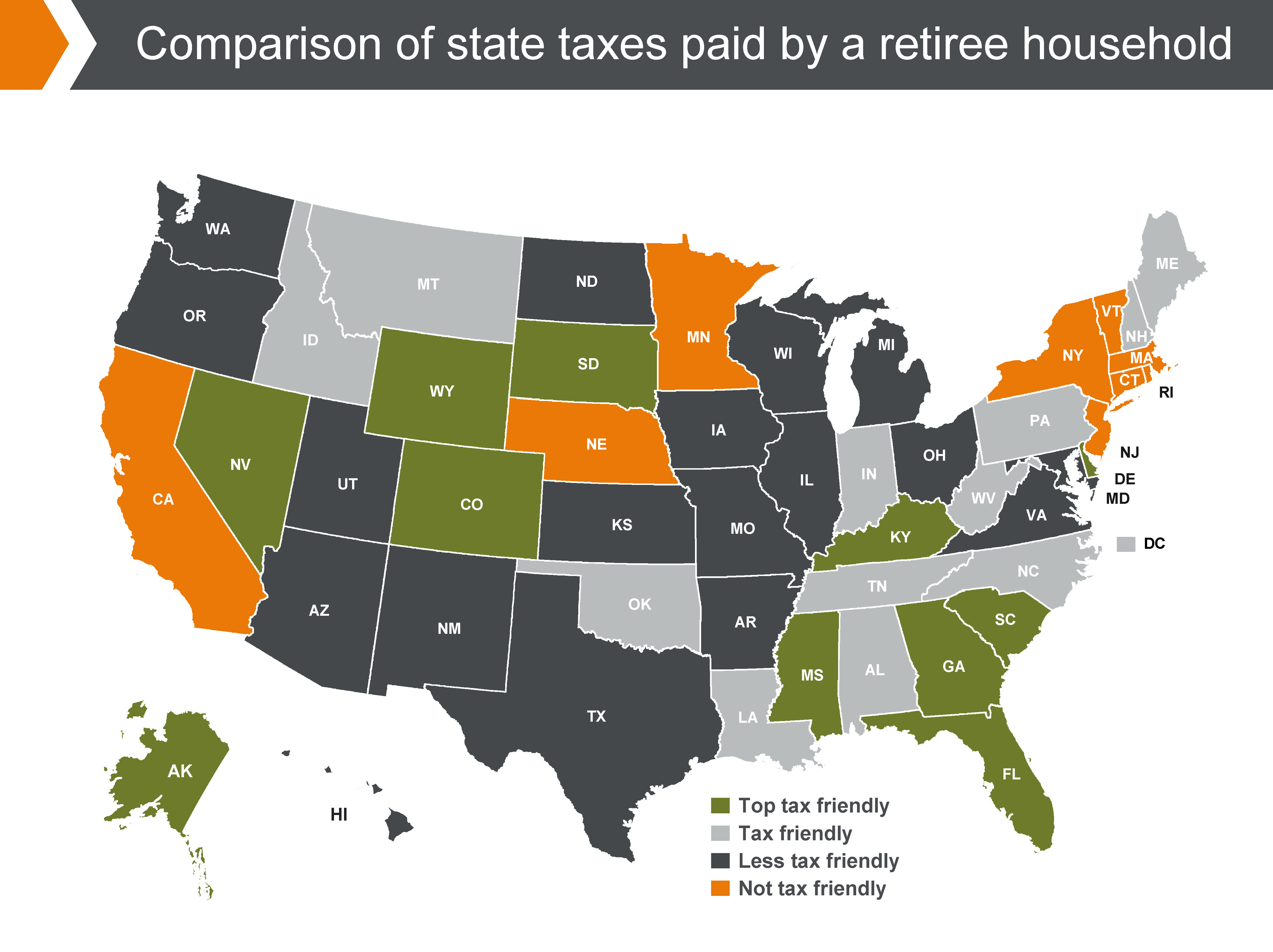

States With The Highest And Lowest Taxes For Retirees Money

Property Taxes By State Embrace Higher Property Taxes

Secured Property Taxes Treasurer Tax Collector

Understanding California S Property Taxes

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Pennsylvania Property Tax Calculator Smartasset

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Pennsylvania Property Tax H R Block

:max_bytes(150000):strip_icc()/dotdash-TheBalance-best-and-worst-states-for-property-taxes-3193328-final3-4972494b00d447d58e8943ad5b82913e.jpg)

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

Posting Komentar untuk "State College Property Tax Rate"