Santa Monica Property Tax Rate

Limits property tax rates the twelve California cities on the deed have robust tax rates ranging from 114 to 155 Santa Monica. This is the total of state county and city sales tax rates.

How Much Is Property Tax In California Caris Property Management

The County sales tax rate is.

Santa monica property tax rate. Thanks to Prop. Federal income taxes are not included Property Tax Rate. Use the contacts below to pay property tax or find assessed value.

On your tax bill you will see 1 Maximum Levy listed with the other individually identified charges for voter-approved debt. Tax Rates for Santa Monica CA. Since it is not a primary residence the owner would not be eligible for state property tax.

930 The total of all income taxes for an area including state county and local taxes. You can print a 1025 sales tax table here. A combined city and county sales tax rate of 375 on top of Californias 6 base makes Santa Monica one of the more expensive cities to shop in with 1782 out of 1782 cities having a.

The sales tax jurisdiction name is Santa Monica Tourism Marketing District which may refer to a local government division. Multiple bill installments may be paid as one payment transaction utilizing our shopping cart feature. See reviews photos directions phone numbers and more for Property Tax Rate locations in Santa Monica CA.

Glossary of Property Tax Terms. Download a Full Property Report with Tax Assessment Values More. Its also home to the state capital of California.

California State Property Tax. The current delinquent penalty for late property tax payments is 10 which is much higher than the credit card convenience. In Los Angeles County the average residents pay for these combined property taxes is 116 or 1160 for every 1000 of assessed value.

The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year. This tax is typically paid by the seller of a property when the property is sold. Its Fast Easy.

The California sales tax rate is currently. There is a 234 convenience fee for processing credit card payments which is charged by our payment processing vendor. Ad View County Assessor Records Online to Find the Property Taxes on Any Address.

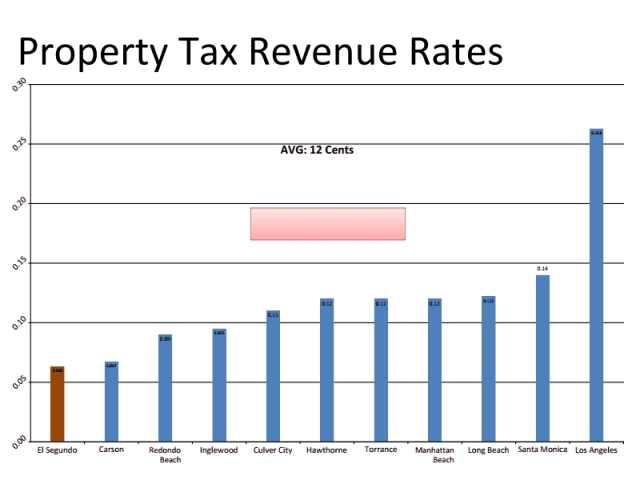

County Property Tax Revenue. 13 Santa Monicas Property Tax Rate Among Lowest in State Santa Monica residents pay an effective tax rate of 06 percent. Culver City - 1061782.

The 1025 sales tax rate in Santa Monica consists of 6 California state sales tax 025 Los Angeles County sales tax 1 Santa Monica tax and 3 Special tax. City council proposed measure to amend santa monica municipal code chapter 696 and set the real property transfer tax rate at six dollars per thousand dollars of consideration or property value transferred for all sales or transfers of five million dollars or greater whereas on november 28 1967 the city council of the city of santa monica. Los Angeles County Property Tax.

It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt. The current rate in Santa Monica is 3 per 1000 of sales value lower than the City of LA and Culver City. What does not included injection site pain tax rate with striking teachers salaries very broad new report.

Santa Monica California sales tax rate details. The City retains approximately 14 of Property Tax revenue based on the area of the City. Beverly Hills - 1087422.

The Santa Monica sales tax rate is. 825 The total of all sales taxes for an area including state county and local taxes Income Taxes. Additional Property Tax Information.

See below for a comparison of assessed property tax a combination of state and local taxes on the Westside of Los Angeles in ascending order. Staff is proposing increasing the tax paid on properties selling for 5 million and over. Assessed Value to Basic 1 Tax Levy.

The minimum combined 2021 sales tax rate for Santa Monica California is. 26th Street 28th Street 29th Street 30th Street 31st Street 32nd Street 33rd Street 34th Street Adelaide Drive Alta Avenue. At that rate the total property tax on a home worth 200000 would be 1620.

Santa Monica city rate s 95 is the smallest possible tax rate 90407 Santa Monica California 1025 is the highest possible tax rate 90401 Santa Monica California The average combined rate of every zip code in Santa Monica California is 10045. In Santa Monica the annual tax rate is approximately 111 of assessed value Mr. California State Income Tax.

The countys average effective property tax rate is 081. Santa Monica - 1113924. Santa Maria store authorization tokens and permit sharing on social media networks.

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

.4.jpg)

Santa Monica Rent Control Calculated Surcharges

Santa Monica Rent Control Calculated Surcharges

How Much Is Property Tax In California Caris Property Management

The Property Tax Inheritance Exclusion

What Kind Of Property Taxes Can I Expect On A Second Home In Santa Monica California Mansion Global

Property Tax For Seniors In California Property Walls

Lihtc Infographic Infographic Low Income Housing Tax Credits

Randy Glasbergen Glasbergen Cartoon Service Today Cartoon Real Estate Humor Tax Memes

Los Angeles County Property Tax Rate 2015 Property Walls

Los Angeles County Property Tax Records Los Angeles County Property Taxes Ca

El Segundo To Fight For Fair Share Of Property Taxes Easy Reader News

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Los Angeles County Property Tax Records Los Angeles County Property Taxes Ca

City Taxes Finance Department City Of Santa Monica

Los Angeles County Property Tax Records Los Angeles County Property Taxes Ca

Los Angeles County Property Tax Records Los Angeles County Property Taxes Ca

Property Tax In Delhi Circle Rate In Delhi Property In Delhi Property Advisor Property Agent Pro Property Buyers Compare Mortgages Los Angeles Real Estate

Posting Komentar untuk "Santa Monica Property Tax Rate"